3 Reasons You Are Paying Higher Than You Should For Credit Card Processing

3 Reasons Why You Are Paying More Than You Should For Credit Card Processing

Reason #1: Credit Card Processing Companies Know You Aren’t Savvy

Unless you have worked in the credit card processing industry, and fully understand the lingo and way things work, most companies selling this service know you aren’t savvy.

This allows most credit card processing companies to take advantage of you without even realizing it when signing up or switching your processing over to them.

This is done a couple ways…

1) For Websites: The quoted rates on their site are normally for bucket/tiered pricing, and the proposed rate is the rate you will ONLY pay for qualified transactions. In most cases, they don’t even communicate what you will pay in surcharges when taking mid or non-qualified cards. (Most of your transactions will fall in the mid and non-qualified range when calculating what you will pay in fees. This is what causes you as the entrepreneur to get burned.)

2) For Offline: When a sales rep calls you to pitch you over the phone, the rate they are promising to lower can be either the “qualified rate”, or the “pin debit transaction rate” within a tiered/bucket pricing structure.

Again keep in mind…this still allows them to make the mid or non qualified rates for those type of transactions whatever they want within the tiered/bucket pricing structure they will most likely sign you up on! (Yes…this is really deceptive…so keep reading)

—

Because points #1 and #2 are true, this causes you a lot of frustration after you sign up or switch to a new processor.

After receiving your statement…you notice that you were charged more than you were anticipating…and this makes you very mad.

By keeping you confused and un-savvy about what you are being charged, and how you are being charged, allows the processors to line their pockets while making you believe they are giving you a fantastic deal!

(It’s hard for you to really know this is happening because they make the statements so confusing for you to read, and they know you won’t make the effort to learn how to because you have too many other things going on…like serving your customers!)

So…a key takeaway for you is…

If you are having a conversation with a rep that leads with a “teaser rate,” or are viewing a website that is showing only one rate…turn around and run…because all that rep or company cares about is hooking you in, and then lining their pockets.

What I Recommend: Make sure you work with someone who will go over everything with you in the most transparent way possible, so you are 100% clear about what you are being charged and the purpose for every fee and rate being billed. (This is how I do things, because I would expect the same respect and courtesy from someone working with me.)

Reason #2: Most Sales Reps Selling Credit Card Processing Services Aren’t Educated Themselves

Because most of the reps selling credit card processing services aren’t fully educated or truly understand how the credit card processing industry works, they aren’t able to help you optimize your situation to help you get the best deal for your business.

What I Recommend: Make sure you work with someone who has proven to you they know what they are talking about before you ever begin the conversation about your credit card processing service. Also make sure that the person you are dealing with asks the right questions about your business so they can set you up in the best way possible.

(I work with people who have been in the business for over 12 years, and who have trained me to the point where I am savvy enough to be able to tell if you are being taken to the cleaners right from the start. Plus consider this…I wouldn’t have been able to create this valuable page for you if I didn’t know what I was talking about!)

Reason #3: You Aren’t On “Interchange Plus Pricing” or Know About What is Fair To Charge for Other Fees Beyond The “Rates”

One of the most important reasons you are paying more than you should is because you aren’t on interchange plus pricing. Any other pricing structure is deceptive, and is structured in a way to make you THINK you are getting a great deal, when in fact you are getting robbed blind.

Because of reason #1 above in this list, most processors can get away putting you in the pricing structures that don’t serve you, making it a total win/lose situation where you get the short end of the stick. The sad part for you is that in most cases you don’t even know you are being taken.

Adding to this, how would you even know what is a fair fee to be charged on a per transaction basis, or for the monthly service fee? Unless you have used a few credit card processors in the past, or worked in the industry yourself, you are making a decision completely blind, causing your bottom line to suffer!

(I only put the people I work with on interchange plus pricing because it is the fairest pricing structure, and is the most transparent way for the business owner to know, understand and anticipate what they are and will be charged every month for their service.)

(When I started learning about the other deceptive pricing structures processors knowingly put their clients into when they could have instead provided them the best deal with interchange plus pricing…IT MADE MY BLOOD BOIL, and I wanted to be part of the solution. As an entrepreneur, I hated knowing people in the community I was a part of were being taking advantage of without even knowing it!)

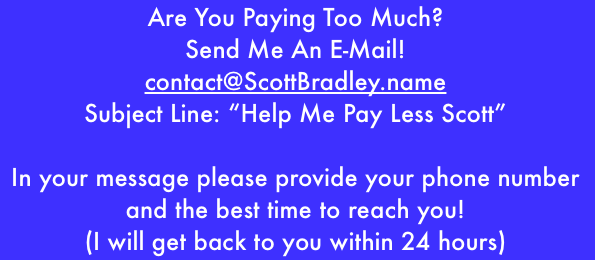

(Click The Blue Box Below To Send Me an E-mail!)

Before You Contact Me I Want To Let You Know A Few Things…

1) If you decide to let me help you, I will provide you a transparent look at what you are currently being charged, and how I will be able to save you money. Each proposal I create for clients breaks it down in a way where there are no hidden fees or “under the table gotcha’s” because I just don’t believe in doing business like that. (If you can’t already tell this is true after reading this page, please click the red X in the corner of your browser.)

2) I will take the time to fully understand your business, so I will be able to set you up with the best deal possible. This will create a mutually beneficial win/win situation for the both of us. (I only do business where there is a win/win, and despise those who do business any other way.)

3) I will provide you the best one-on-one customer service experience you will ever have. (Most reps drop out quickly, leaving you holding the bag where you have to call an 800 number to speak to someone in India. Even if you can’t get a hold of me (wich will rarely if ever happen!), the company I work with has a live operator answer that is in the USA if there was ever an emergency that needed someones immediate attention.)

4) There is absolutely no pressure. If you choose to have me draft up a proposal for you, please know that there is no obligation to do business with me. You still have the choice to reject what I am proposing, and that is perfectly alright.

5) A lot of my background is in helping companies increase their sales by creating better marketing. When I started realizing how entrepreneurs were being taken advantage of by their credit card processor, and how this directly impacted the bottom line, I knew I had to do something about it! This is why you are on this page right now. I really do want to help you get the best deal and keep more profit that is deservedly yours in your business!

Ok now send me an e-mail! I want to help you get the best deal possible!

I look forward to hearing from you!

Please feel free to leave any questions you have below!

{ 0 comments… add one now }